Summary of the Proposed Tax Reform Project Through Senate Bill 1888 and House Bill 3028 - Martino-Luna Attorneys and Counselors At Law

Main menu:

- Home

- About

- Areas of Practice

-

News

-

Tax Articles and News

- Taxation of Foreign & Non US Citizens Taxpayers

- Sourcing Rules of Puerto Rico BONA FIDE Residents Receiving Income from U.S. Employer

- Temporary Tax On Foreign Corporations

- Withholding Rules Of Income And/Or Compensation Under The Current Provision Of The Puerto Rico Internal Revenue Code

- Summary of the Proposed Tax Reform Project Through Senate Bill 1888 and House Bill 3028

-

Tax Articles and News

- Contact

- Taxation of Foreign & Non US Citizens Taxpayers

- Sourcing Rules of Puerto Rico BONA FIDE Residents Receiving Income from U.S. Employer

- Temporary Tax On Foreign Corporations

- Withholding Rules Of Income And/Or Compensation Under The Current Provision Of The Puerto Rico Internal Revenue Code

- Summary of the Proposed Tax Reform Project Through Senate Bill 1888 and House Bill 3028

News > Tax Articles and News

Summary of the Proposed Tax Reform Project Through Senate Bill 1888 and House Bill 3028

The taxing system of the Commonwealth of Puerto Rico is a very complex set of rules that throughout the years has been amended continuously, creating a very complex and obsolete tax code. There have been efforts to create a more efficient taxing system, but each and every year it ends up being more complicated. Our current Internal Revenue Code was enacted in 1994, and it has dragged parts of previous codes, plus all of the amendments that are being introduce to it on a yearly basis.

Nonetheless, currently there is a tax reform project being pushed in Puerto Rico that will conclude with the introduction of a new Internal Revenue Code. The project is part of Senate Bill 1888 and House Bill 3028, announced by the Governor a few weeks ago. Even though, it is being implemented through several pieces of legislation, which will affect our whole taxing system, the end product will be a new Internal Revenue Code.

Even though it will be implemented in phases (tax years 2010 up to 2016), there will be some implications in the 2010 tax year that is winding up, and for which we file next April 2011. Between the most important changes, most of which will be available for the 2010 tax year, are mentioned below:

- Tax credits to individuals (7%-15%) depending on the reported adjusted gross income and if they are filing jointly or separately.

- The tax credits to individuals (7%-15%) will be available only for the 2010 tax year, and it cannot be used to reduced the income tax liability related to income items subject to special rates such as dividends, interest and capital gains.

- 7% non-refundable tax credit for all non-exempt corporations and partnerships that pay the entire X-Mas bonus to all of its eligible employees.

- Effective for tax year 2010 there will be an increase from 7 to 10 years in Net Operating Loss Carryover incurred from 2005 to 2012.

- Effective for tax year 2010 the mortgage interest deduction will have a ceiling of 30% of the adjusted gross income of the individual. It does not include income items subject to special rates such as dividends, interest and capital gains.

- There will be no withholding on income taxes from payroll and Christmas bonuses during the month of December, 2010. The reductions will be reflected on the 2010 tax returns. (It is not that is not taxable. Just no withholding requirement).

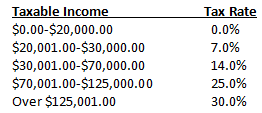

For the Second Phase of the tax reform project, there will be additional reductions in the individuals tax rates that will be implemented as follows if signed by the governor as of now:

Additional changes, most of which will be available for the Second Phase of the tax reform project, are mentioned below:

- Elimination of the 3rd year payment of the Special Property Tax. (September 2011 and March 2012 payments)

- Gradual increase of the Work Credit ($600) and an increase in the limit of income ($35,000), thus maintaining its refundable status. Gradual increase of the Work Credit from $300 to $600 and an increase in the limit of income from $20,000 to $35,000. This credit is expected to maintain its refundable status

- Tax credit ($400.00) to taxpayers of 65 years of age or older with annual income of $15,000.

- 20% Fixed Tax Rate to Taxpayers Participating in Voluntary Declaration Program. Taxpayers that during taxable years starting July 1, 2003 and ending December 31, 2009, received, or accumulated gross income subject to tax, and did not filed the corresponding returns, or made any payments, or filed a return and has not included the correct amount of income on his return. No interest, penalties or surcharges will be imposed to the taxpayers who participate, and will also applies to any taxpayer that had volume of business and has not filed the required Volume of Business Declarations or paid the correct corresponding amount of municipal license tax, or having filed the declaration, did not declare the correct amount.

- Program will not be available to taxpayers that are under investigation by the Treasury Department or any municipality, or under criminal investigations; to corporations that enjoy exemptions or reductions pursuant to Act. No. 73 of May 28, 2008, as amended, known as the Economic Incentive Act for the Development of Puerto Rico, and Act No. 74 of July 10, 2010, known as the Puerto Rico Tourism Development Act or any other law of similar nature; and, taxpayers that had not filed or paid property taxes, since a property tax amnesty is currently in effect pursuant to Act No. 71 of July 2, 2010.

Other provisions include:

- Electronic filing of the sales and use tax returns, and changes in the minimum amounts required to deposit the tax by electronic transfer.

- Statutory Deductions will be reduce to only 5: a) Mortgage Interest, b) Charitable Contributions, c) Medical Expenses, d) Student Loans, and e) Retirement Accounts Contributions

- Informative return provisions.

- Simplification of filing status: single, married filing jointly and married filing separate.

- Elimination of the Gradual Adjustment by year 2015.

- Reduction in PYMES rates (20% to 30%)

- 20% fixed tax rate to taxpayers participating in voluntary declaration program.

- Criminal charges to withholding agents.

- Penalty Provision (considered criminal offenses on new tax code).

- Temporary tax on foreign corporations that manufacture products, and or services, to be offered outside of the island (mostly pharmaceuticals). The Controlled Foreign Corporations or CFC's. Temporary. It will be a six year tax with the following rates: 4% 1st year, 3.75% 2nd year, 2.75 3rd year, 2.50 4th year, 2.25 5th year and 1% 6th year. Tax will apply to the acquisition of personal property and services by a non resident individual or entity (corporations, partnerships, etc.), that has a current office or business operation. Tax will be paid to local Treasury every 3 months in a special return that Treasury will publish. Tax imposition will be applicable to foreign corporations that generate more than $75 million a year.